PARKS PROPERTY ADVICE

-

GLOBAL TRENDS

-

1st QUARTER 2015

-

3rd QUARTER 2014

-

2nd QUARTER 2014

-

US property market crash imminent

Everything we've suspected about the US market is coming to fruition: housing is crashing (again), unemployment and stagnant wages have crimped spending, the US Federal Reserve is fumbling as it tries to rein in its stimulus, and all indications are that the US is already slipping into another recession. Starting with the housing market, there are signs of some eerie parallels with 2007. Here's a look at existing home sales over the past year...

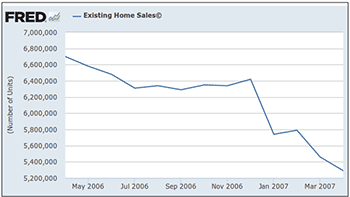

Does that look familiar? It should. Here's what the same one-year graph looked like in May 2007...

The housing “recovery” that so many economists touted last year has not only stalled, but reversed course. It's a drag on the economy, a liability. Applications for mortgages to buy homes are down 21% from this time last year. Residential fixed investment (which includes construction, home repairs, and broker commissions) fell 5.7% in the first three months of the year. That's the second straight quarter of declines, after a 7.9% drop in the fourth quarter of 2013. To put that in perspective, residential investment accounted for 3.1% of GDP in the fourth quarter, less than half the peak contribution of 6.6% in 2006.

The flailing housing market is the perfect example of what happens when stimulus wears off. First, the government ended its subsidies, and then the Fed cut down its purchases of mortgage-backed securities. The result has been lower demand for sellers and higher interest rates and prices for buyers. Predictably, the whole thing is coming undone.

All the signs are that the broader US economy and the stock market are going to follow the exact same trajectory. Just when it looks like things are back to a pre-recession standard of normality, the bottom falls out. As the economy continues to slow and the Fed stops buying bonds, the stock market will plummet. It will happen suddenly and it will be drastic. We're forecasting a 20% decline, at the least. That's why now is the time to start taking precautions.